Other Work Related Expenses 2024 – You may be eligible to deduct other unreimbursed work-related expenses, such as professional and union dues, legal fees you incurred as part of keeping your job, medical expenses required by your . Compensation for your home internet, from your employer or the IRS, isn’t likely, but it’s not impossible. Here’s how you might get a little back. .

Other Work Related Expenses 2024

Source : www.facebook.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com2024 Corporate Work Plan and Operating Expenses Budget

Source : www.linkedin.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comStart the new year off strong by adopting some financial health

Source : www.instagram.comGCSC Gulf/Franklin Campus | Port Saint Joe FL

Source : www.facebook.comStill Chasing Employees For Expense Receipts in 2024?

Source : www.fylehq.comUPDATE 1/15/2024 The Snow City of Sterling City Hall

Source : www.facebook.comAmazon.: JUBTIC Budget Planner 2024, Monthly Budget Book

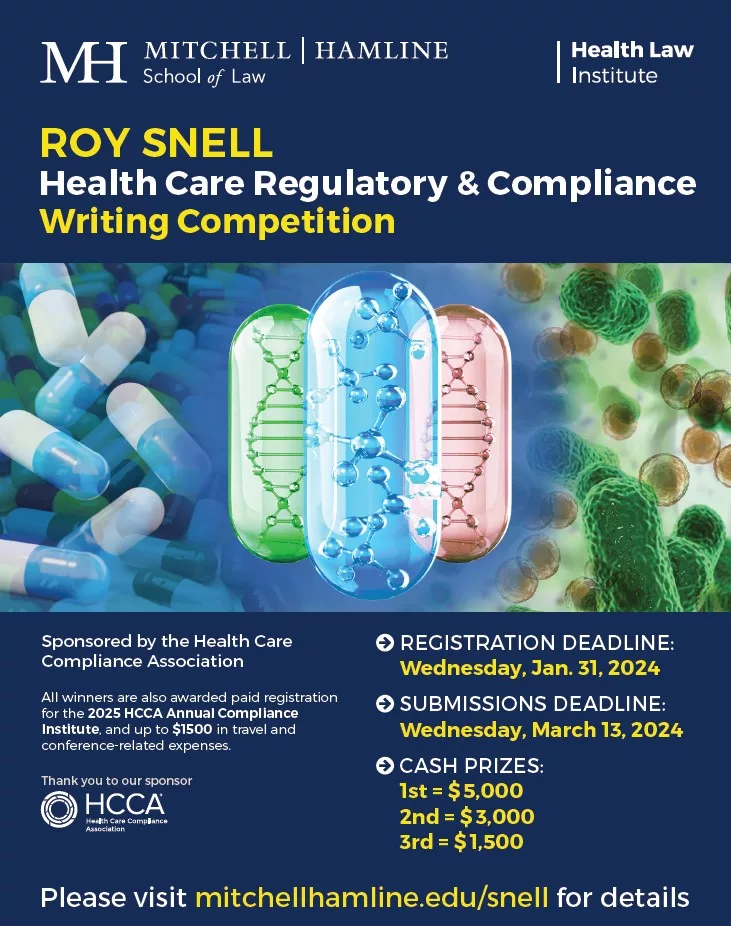

Source : www.amazon.comRegister for the 2024 Roy Snell Writing Competition – open to all

Source : mitchellhamline.eduOther Work Related Expenses 2024 Management Connections Lake County | Lakeport CA: and incurring other work-related expenses. Studies by Aon Consulting support this rule of thumb. A study by T. Rowe Price in 2014, however, concluded the 80% rule might be too high for many people. . In other words, it’s intended to cover dependents The amount of the credit is based on a percentage of work-related expenses and can be up to 35% of your costs. There are caps on the .

]]>